You can’t go anywhere and not hear about inflation hitting everything from food, to oil, to cars, and furniture. Whether you ultimately believe it’s transitory or not, it’s an interesting time on the pricing front for brands/mfgs.

Tag: COVID-19

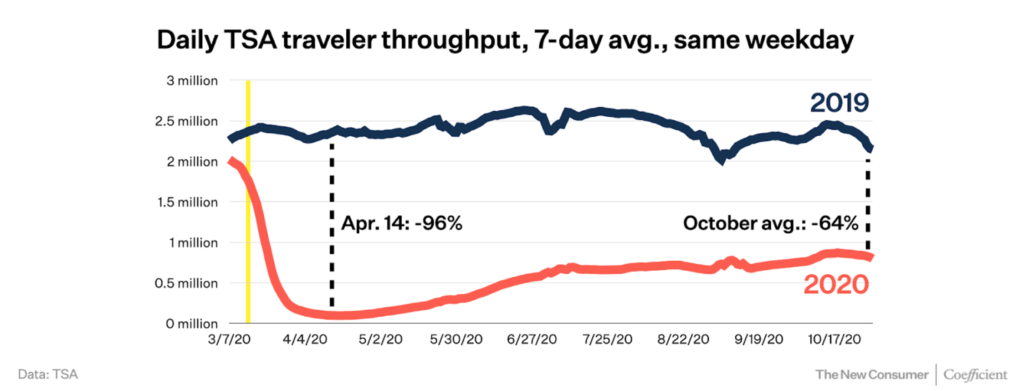

Happy New Year! When I see a chart like the above, it’s unfathomable to believe that it’s a good time to be in the airline business, let alone be a startup trying to enter the capital intensive sector. But that’s what David Neeleman (the founder of JetBlue) plans to do. History is littered with failures of upstart airlines due to a myriad of factors that make it an extremely difficult sector to compete in. Today’s 3 large legacy carriers (Delta, United and American) are the result of years of consolidation and currently control ~50% of the US market.

This is the first year that sales on Cyber Monday are expected to exceed Black Friday, but then of course, this year is anything but normal. I’ve never been a fan of the whole holiday shopping frenzy. As food lines extend miles and millions of people remain unemployed, it’s more important than ever to give back this year.

Investing in airlines has never made sense. As Warren Buffet once said “if a far-sighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.” Buffet never liked airline stocks, but did see a possible entry point after years of consolidation to make an investment in Delta which he followed through on. That’s now a distant memory as Berkshire recently cashed out their holding following the pandemic. It’s for this reason that you haven’t, and won’t, see startups getting into the airline business; it’s too competitive and capital intensive with meager margins to make the business attractive to growth stage investors. But you are seeing aviation tech on the fringes of the industry attract VC money. Jetblue Technology Ventures, for example, has made numerous investments in the travel sector.

This is a period of immense uncertainty but also a time for great opportunity. Some of the most well known companies were created during past periods of volatility. Apple and Microsoft were born during the OPEC induced recession of the 1970’s. Netflix survived the Dot.com bubble and came out stronger than ever, and Airbnb was born during the 2007-2008 recession. Fast forward to today and there seems to be two schools of thought on investing during the current Covid-19 pandemic. Either it’s batten down the hatches and conserve cash or let’s use this as an opportunity to double down on our winners and also invest in other startups that are booming due to stay at home restrictions. As we’ve seen in the public markets there are multiple bulls out there in certain sectors and the same theme applies to venture.

Venture capitalist Marc Andreessen coined the term “Software is eating the world” nearly 10 years ago. His argument that software would be at the heart of every business moving forward could not have been more astute. For example, Amazon’s not a retailer; their primary capability is their software technology enabling sellers around the world to get their products to consumers. The same could be said for their AWS cloud business; again a software play. Uber, Google, Facebook, Netflix, and to some extent Apple’s app store business, are all examples of companies that are fundamentally software first. Interestingly, this same software has empowered a foundational shift in business model. It has enabled disintermediation. The complex network of intermediaries that have existed historically have been circumvented which has led to the world of everything being direct-to-consumer (D2C) or direct to source. Many think of D2C as mainly having an impact on consumer goods, but the theme permeates into numerous industries. Here are some examples:

It’s been interesting to watch Q2 play out in VC land – especially given the disconnect between Wall Street and Main Street throughout the Covid pandemic. While initially a cataclysmic drop-off in funding was expected, the industry overall was not as affected as originally thought. Similar to the public markets, many investors continued to see a buying opportunity and had re-allocated their portfolios to support their likely winners. A key takeaway – early stage funding continues to face some challenges while late stage appears to have fared better. Many early stage B2C companies, however, are struggling.

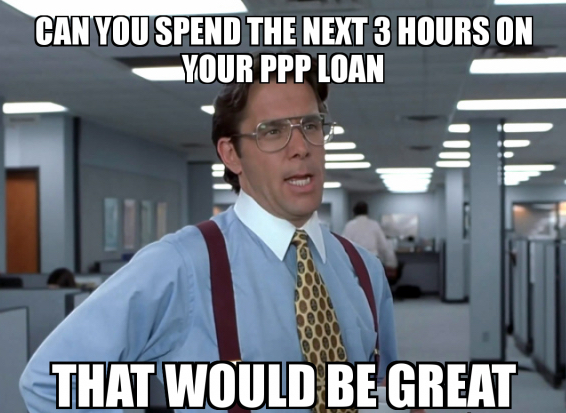

I’ve been reading a lot of commentary recently on tech companies that took PPP loans during Covid. Was this right? What’s definitely not right is our government bailing out bloated corporations during the pandemic. If you believe in capitalism then we should let the free markets take their path and prune the weak. One would argue that this infusion of cash saved jobs. Not sure how true that ultimately will become in October when the stipulations attached to the loans disappear. I bet we’ll see more layoffs, lots of them. US airlines have already made announcements for layoffs as soon as they are legally able. So basically taxpayers have funded a short term experiment on borrowed time that was setup for failure from the beginning. Harvard economists agree, the program has had little impact on employment at small businesses to date.

I’ve been thinking a lot recently about why much of the venture capital ecosystem hasn’t invested in innovation that could really help stem some of the challenges we are facing during this pandemic; areas around synthetic biology, contract tracing, vaccine development and even our antiquated unemployment systems. The fact that millions of Americans haven’t been able to access unemployment benefits due to systems that are 20-30 years old is mind boggling, especially when 75% of venture capital dollars goes to software that ultimately could alleviate these challenges. The main culprit: Privatization of US innovation.

Back in October of 2019, I wrote a piece on how all the value creation was essentially being captured in the private markets and retail investors were being left out. It wasn’t always this way (think Amazon or Neflix’s IPO). Over the last 3-5 years, startups have been staying private longer as late stage capital keeps funneling in. Blame traditional firms like TRowe and Fidelity, and Softbanks massive Vision fund among others, for providing the cash. Venture has always been an alternative asset class and fund managers are seeking growth in areas outside of traditional channels.