The big management consulting firms will have to adapt quickly to AI. The days of paying half a million dollars for a strategy deck are over. By way of example, I was curious, what is next for the food delivery sector (e.g. UberEats, DoorDash, etc) so I put together a prompt and leveraged ChatGPT.

Category: Startups

Back in March 2023, I wrote this article about how I was beginning to leverage AI (specifically ChatGPT) in helping me frame business partnerships. This was relatively early in the commercialization of AI. That now feels like an eternity as the space continues to evolve. Today’s post is not an overview of AI – for newbies I highly recommend LinkedIn Learning’s Generative AI for Business Leaders course taught by Tomer Cohen. Google also has a training module on Coursera for business leaders which is a good primer. It’s easy to go down a rabbit hole trying to wrap your head around the space so my recommendation is to start with the basics and then tailor the learning to your specific field.

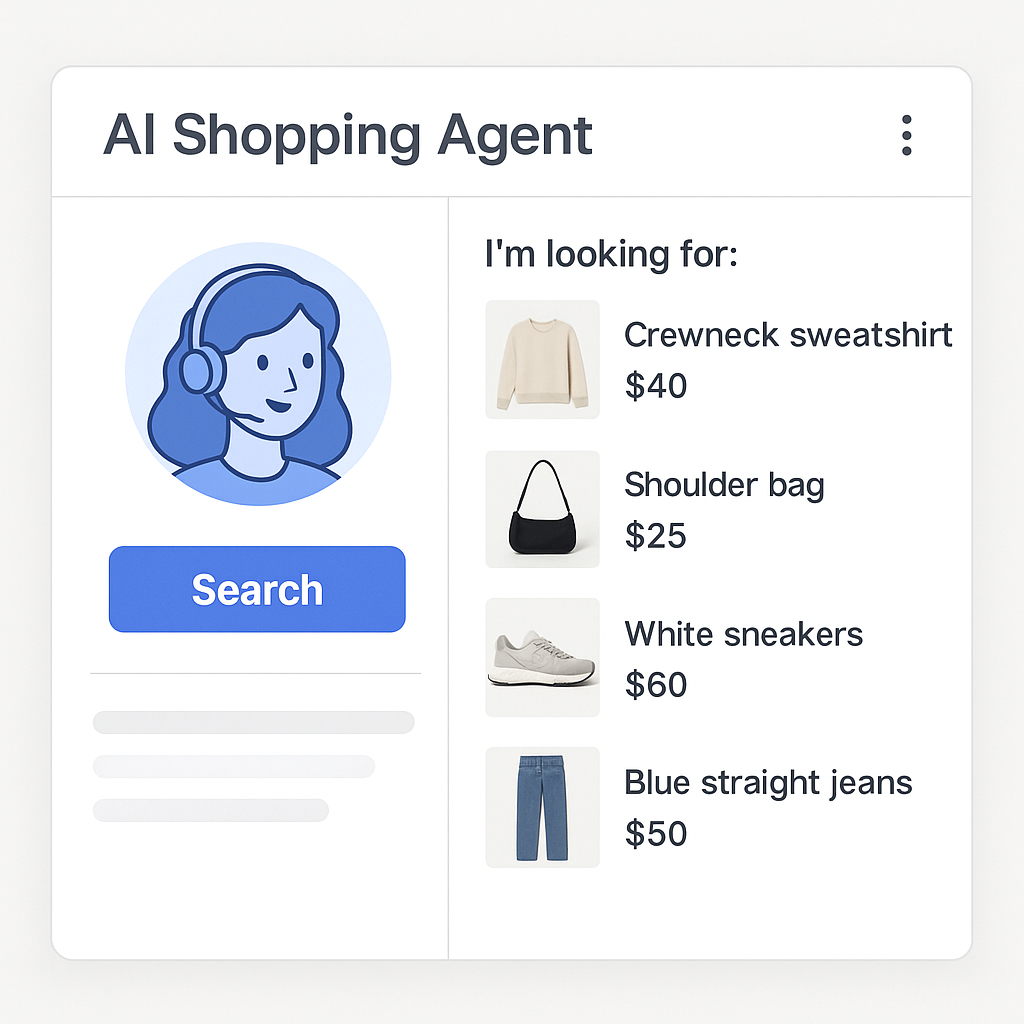

I wanted to share today another use case that has been generating noise and is relevant to retailers and brand marketers – and top of mind for me given my background working in and consulting DTC brands, consumer goods companies, and retailers – the rise of AI shopping agents.

I’ve taken a bit of time off from blogging recently to focus on other things, but recently came across this article from the WSJ about the fall of VF Corp ($VFC) and it reminded me of other legacy brand aggregators, such as Newell Brands ($NWL), that have also struggled as of late. There is a common strategy across both companies – they chose to concentrate key decisions around marketing, product development, and sales at the corporate versus brand level. And the results clearly show that was a mistake.

One of the most difficult aspects of doing partnerships or business development regardless of industry or sector is clearly understanding why two parties should get “married.” In my experience building numerous JV’s/partnerships, one theme continues to resonate, and that is how do you construct a winning partnership where each side feels as if they have gotten equitable value. Oftentimes, initial discussions tend to be more tactical or acutely focused on a very specific asset that one side seeks access to, when the focus should be framing the outcome from inception. This entails being able to articulate clearly the ‘gives’ and ‘gets’ of a deal and not jumping right into the weeds. Jeff Bezos has said, at Amazon, before any work is done on a new partnership, the press release is written. This accomplishes a couple key things.

If you’ve used food delivery apps like DoorDash or UberEats over the last few years, you’ll notice the number of restaurants on the platform has skyrocketed. And interestingly, they all seem to be offering the same types of cuisines. As it turns out, these platforms have become a battleground for testing virtual concepts. In 2021 there were roughly 10,000 virtual brands on UberEats but today that number is now 40,000.

Why is a publisher model appealing to brands? An emerging crop of companies with recurring revenue and large customer bases have discovered that “owning” audiences is better than “renting” them according to CBInsights and ultimately a way to reduce CAC and build more loyalty. Over the last few years, a growing crop of financial service and SaaS based firms have been acquiring media companies – JPMorgan bought the Infatuation, HubSpot purchased the Hustle and Robinhood snatched up MarketSnacks. Make no mistake – this was a play to decrease CAC (customer acquisition cost) and drive up LTV (lifetime value). A recent CEO said “Every company should go direct to its audience and become a media company.” While the noise has mainly been centered on businesses with subscription economics, another cohort that would benefit from this trend are the emerging crop of DTC lifestyle brands that have been growing rapidly over the last 5-10 years. This isn’t unchartered waters; brands have been acquiring media companies for years. Going back to the days following the Dot.com bubble, J&J purchased Baby Center in 2001 for ~$10m with the goal of providing more content to expecting moms. Flash forward to today and the pandemic has created another opportune environment for brands to snatch up media companies. Since the spring of 2020, we’ve seen ecommerce sales skyrocket, digital advertising costs increase precipitously and LTV become paramount leading to the newfound realization that paying to advertise won’t have the same ROI as owning an audience to market to. One of the largest blights these newly public DTC companies have is that they aren’t profitable – the primary reason being the amount of money spent on marketing.

When I consult companies I often get asked about either building a DTC (direct-to-consumer) strategy or growing wholesale/retailer partnerships. The argument for DTC is rooted in the continuing belief that it’s more profitable than selling your physical product through retailers. But what if it’s really not? There’s definitely arguments in support of a DTC strategy (better control of the brand experience, ability to collect 1st party data for consumer insights, offer a more personalized customer experience, etc) but it’s important to be realistic with your investors/stakeholders that there’s very likely a fallacy that it will be better for the bottom line.

I’ve written before about the appeal of partnerships and Peloton’s recent deal with United Healthcare (UHC) is another example of why this can be extremely powerful. Beginning in September, UHC customers on employer sponsored plans will get complimentary access to Peloton’s digital subscription for one year. Afterwards, customers can continue and pay Peloton directly or simply let the subscription lapse. We’ve seen trial deals on entertainment subscription products now for a few years (think Netflix and TMobile, Verizon and Disney+, Hulu & Spotify, etc), with more likely in the pipeline. All of these services struggle with high customer acquisition costs and partnerships are an extremely effective way to grow.

What do Peloton, Express, Urban Outfitters and J.Crew all have in common? They have items for sale on their websites that aren’t actually theirs. Each of these retailers has taken a page out of Amazon’s playbook and decided to build a 3rd party marketplace of brands to complement their core offering. The main objective is twofold – increase traffic to their site while providing an opportunity to create a new revenue stream.