It seems everywhere you turn, DTC (direct to consumer online brands) are struggling. Between rising input costs and more expensive marketing, the economics of selling online continues to look bleak. Let’s break down the struggle.

Tag: Startups

I’ve written before about the appeal of partnerships and Peloton’s recent deal with United Healthcare (UHC) is another example of why this can be extremely powerful. Beginning in September, UHC customers on employer sponsored plans will get complimentary access to Peloton’s digital subscription for one year. Afterwards, customers can continue and pay Peloton directly or simply let the subscription lapse. We’ve seen trial deals on entertainment subscription products now for a few years (think Netflix and TMobile, Verizon and Disney+, Hulu & Spotify, etc), with more likely in the pipeline. All of these services struggle with high customer acquisition costs and partnerships are an extremely effective way to grow.

Brands aren’t built overnight. Some of the most successful brands (Nike, LVMH, etc) have taken years to achieve the awareness (and more importantly relevance) they have now. In the case of LVMH, there is a key element to owning a piece of European heritage that has driven the company to be the largest luxury goods company in the world. Louis Vuitton owns much of their own supply chain. As an example, over the past couple of years they opened a manufacturing center in Texas to create leather goods here in the US that further allows them to create local stories around their products.

You lease your car. You rent your apartment. You subscribe monthly to Netflix and you rent your clothes from Rent the Runway. But would you rent your furniture? There’s a slew of startups that are betting you will. Companies like Fernish, Feather, Oliver Space and CasaOne are a few that allow customers to rent their furniture and return when they no longer need. The concept isn’t new; legacy players such as Rent-a-Center ($RCII) and Aaron’s ($AAN) have been doing this for years. The difference now is that there hasn’t been an updated brand narrative. Rental furniture has historically been aimed at middle America, subprime borrowers as an alternative to those who weren’t candidates for financing. The loans were borderline usurious or prices were marked up to cover the credit risk.

If you look at the majority of venture backed DTC brands in the market today, they all could benefit from diversifying their revenue streams. As this cohort scales and eventually becomes omnichannel (since that’s the playbook most are following), gross margins will inevitably suffer. When startups expand into new product categories it’s still often challenging to get >50-60% landed margins if you’re selling physical products. This is where services come in.

I’ve been thinking a lot recently about why much of the venture capital ecosystem hasn’t invested in innovation that could really help stem some of the challenges we are facing during this pandemic; areas around synthetic biology, contract tracing, vaccine development and even our antiquated unemployment systems. The fact that millions of Americans haven’t been able to access unemployment benefits due to systems that are 20-30 years old is mind boggling, especially when 75% of venture capital dollars goes to software that ultimately could alleviate these challenges. The main culprit: Privatization of US innovation.

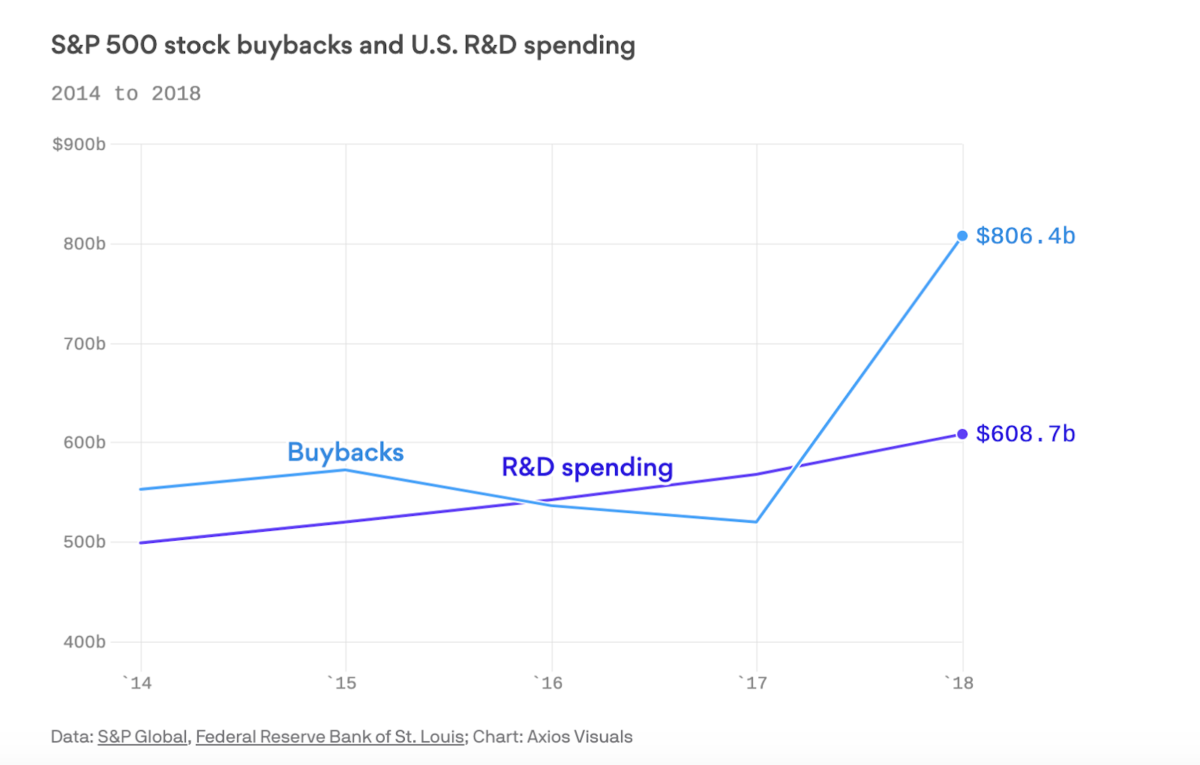

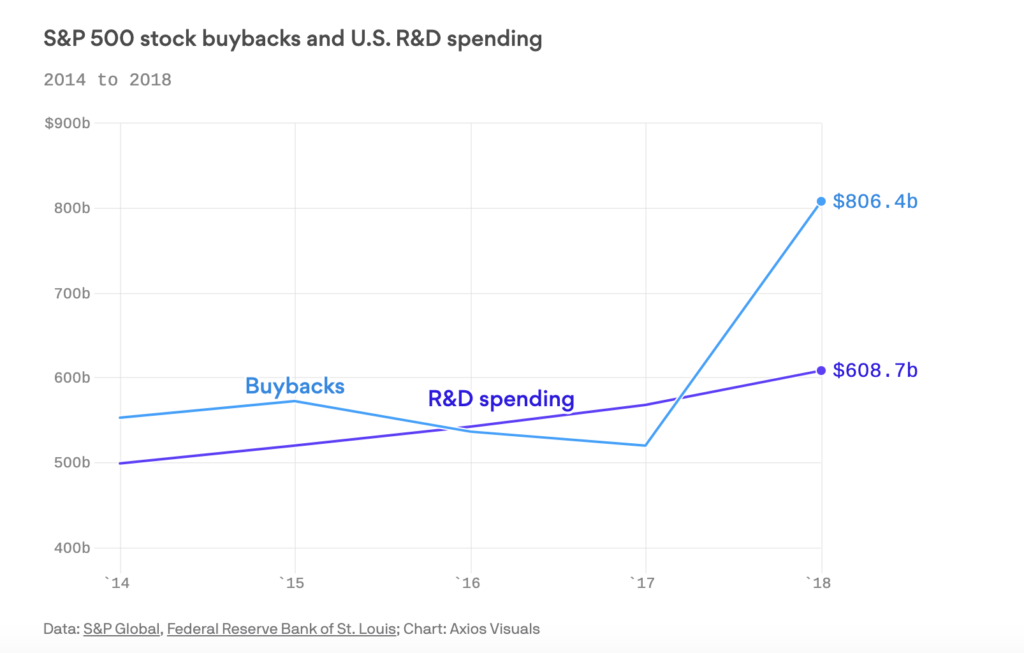

Less than half of the S&P 500 invest any money in R&D. Instead, they are pumping dollars into stock buybacks that ultimately provide no real tangible value to the productivity of the enterprise (sorry Warren). I’m convinced this is stifling innovation and giving startups more room to eat their lunch. Wall Street has no patience when it comes to waiting around to see innovation bare fruit which can sometimes take 4+ years. The unfortunate reality of this is management must then live by a quarter-to-quarter clock which hurts internal innovation. This myopic perspective is further reinforced by hedge funds and activist investors who are chasing short term gains. Allocators of capital need to recognize that management has to be given more leeway to invest for the long run. If they don’t, a heavily funded lean startup will be glad to take their customers.

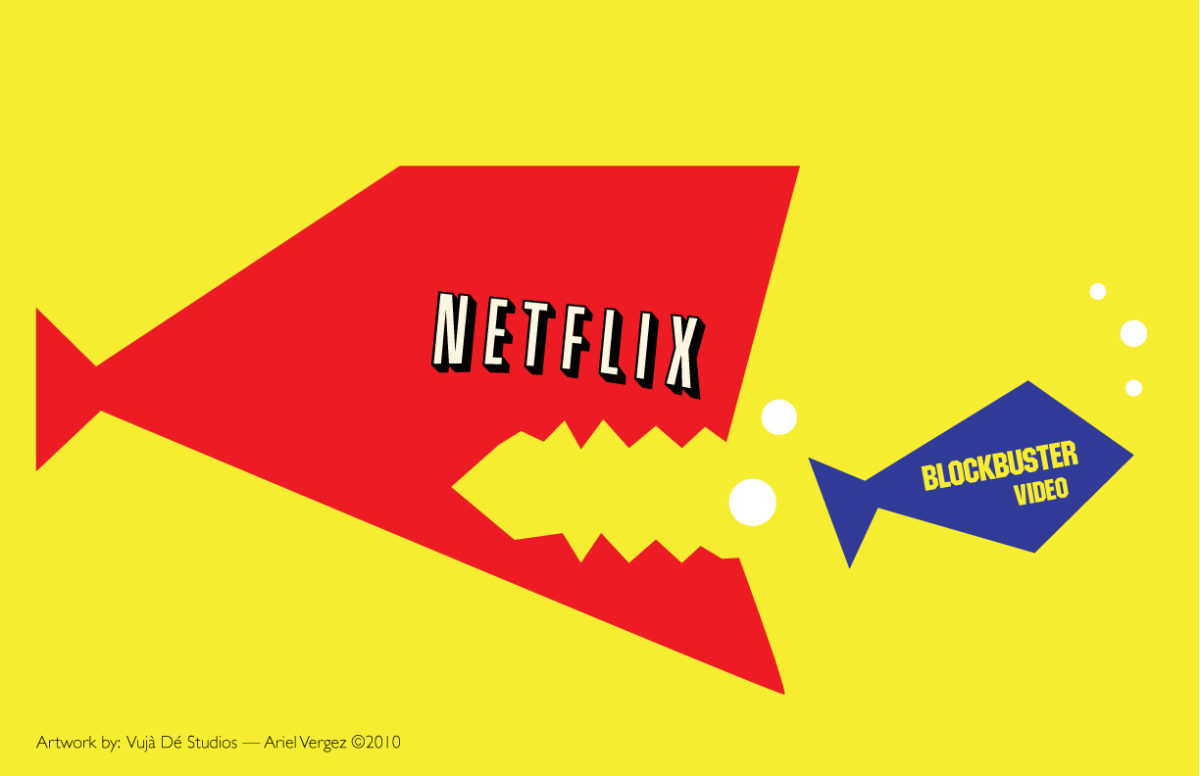

If you haven’t read the Innovator’s Dilemma by the late Clay Christensen I highly recommend it. For those who work in innovation, this book is a wealth of knowledge on how to structure your company to embrace new technologies. Prior to joining the startup world, I spent nearly 9 years at a large S&P 500 corporation where I witnessed firsthand how slow and cumbersome these giant companies are. We held significant market share in many of the niche categories we dominated but slowly it became clear that insurgent brands (startups) wanted a piece of the pie. When large incumbents want to innovate it can sometimes take years to get a new product to market and ultimately the customer (which sometimes can be a buyer at a large retailer) may not even want it. A Harvard Business Review study estimated that at least 75% of internal new business endeavors fail – and this assumes R&D is even a priority. In 2018, less than a half of the S&P 500 companies recorded any R&D expense. The reason for this? Blame share buybacks. Over $200b more was spent on buybacks in 2018 than R&D and one would argue that this has little to no influence on the productive nature of the company. Hedge funds and activist investors chasing short term wins are further enabling this behavior.

Meanwhile tech companies who are spending in R&D are reaping the benefits. Startups are getting products to market 3x faster than incumbents (Bain & Co: 2018). So as a corporation, you must refine your innovation strategy into three parts under a buy, partner, build scenario or be left like one of these folks.

This piece from the NYTimes highlights that B2B (or B2B2C) can be sexy again. Consumerization in this space recently led by Slack, Zoom and Affirm, among others, has shown that there is an increased interest in the sector both from investors and enterprises/end users.