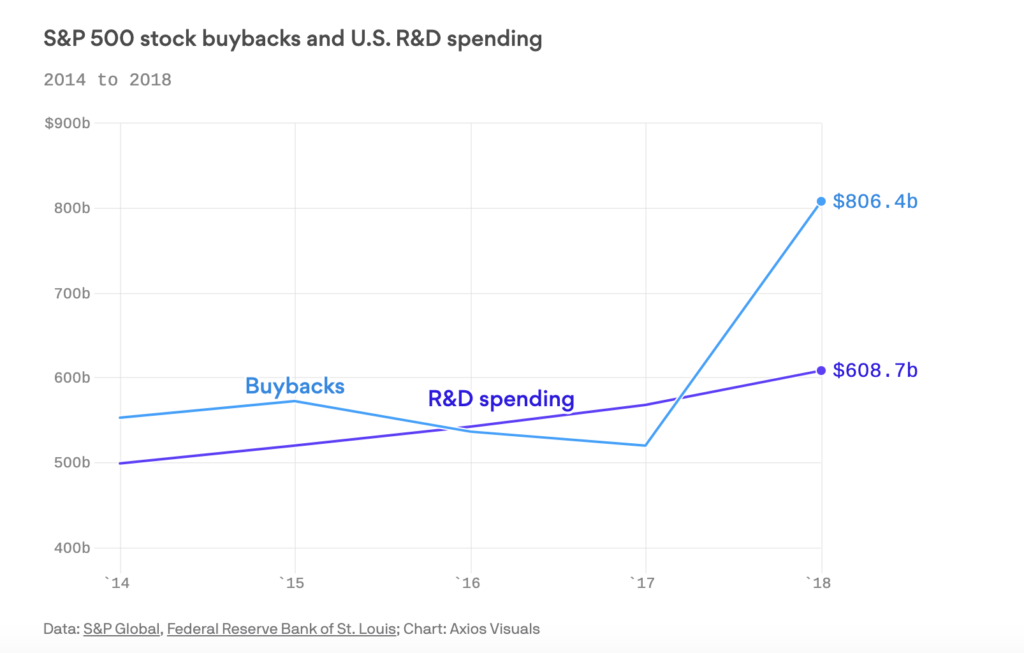

If you haven’t read the Innovator’s Dilemma by the late Clay Christensen I highly recommend it. For those who work in innovation, this book is a wealth of knowledge on how to structure your company to embrace new technologies. Prior to joining the startup world, I spent nearly 9 years at a large S&P 500 corporation where I witnessed firsthand how slow and cumbersome these giant companies are. We held significant market share in many of the niche categories we dominated but slowly it became clear that insurgent brands (startups) wanted a piece of the pie. When large incumbents want to innovate it can sometimes take years to get a new product to market and ultimately the customer (which sometimes can be a buyer at a large retailer) may not even want it. A Harvard Business Review study estimated that at least 75% of internal new business endeavors fail – and this assumes R&D is even a priority. In 2018, less than a half of the S&P 500 companies recorded any R&D expense. The reason for this? Blame share buybacks. Over $200b more was spent on buybacks in 2018 than R&D and one would argue that this has little to no influence on the productive nature of the company. Hedge funds and activist investors chasing short term wins are further enabling this behavior.

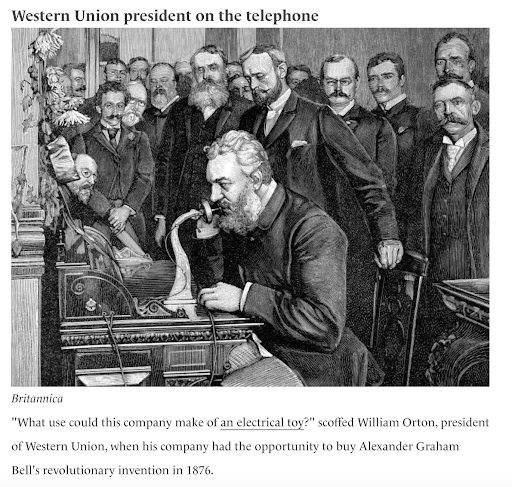

Meanwhile tech companies who are spending in R&D are reaping the benefits. Startups are getting products to market 3x faster than incumbents (Bain & Co: 2018). So as a corporation, you must refine your innovation strategy into three parts under a buy, partner, build scenario or be left like one of these folks.

And even this guy……..

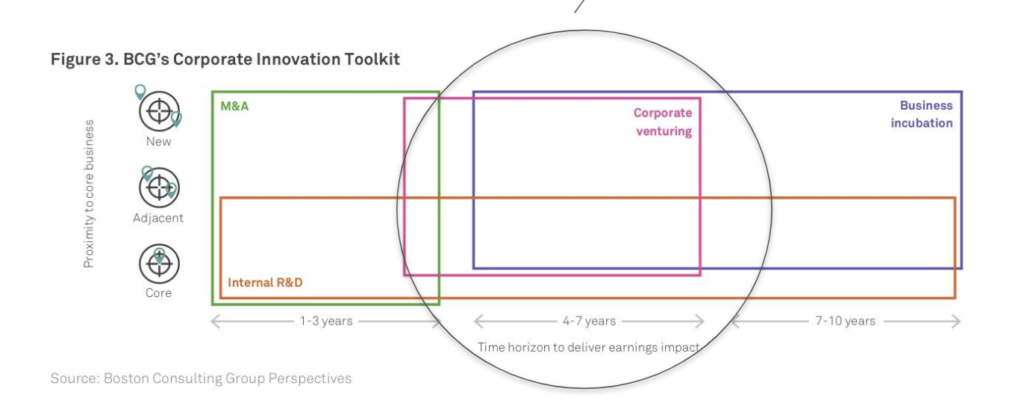

The Three Innovation Paths:

Part 1: M&A (Buy)

Part 2: Corporate Venturing (Buy/Partner)

Part 3: Internal R&D/business incubation (Build)

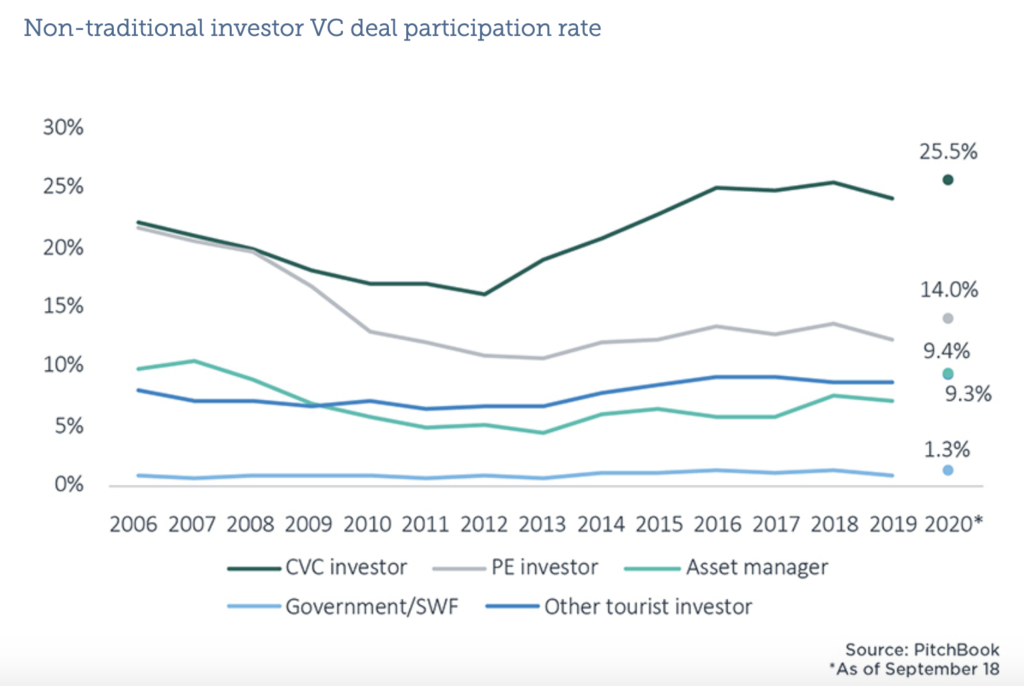

Corporate venturing (also known as corporate venture capital) is the area that is most foreign to companies. The idea is to capture insight into disruptors before they grow too large. I’m going to provide an overview now of the different aspects of the Venture ecosystem and how companies can get involved. Today, nearly one quarter of all venture capital deals involve a corporate investor as companies realize they must innovate. It’s not okay simply to sustain innovation, you must disrupt.

Crawl: The simplest way to get your foot in the venture ecosystem is to sponsor an incubator or accelerator. There are numerous ones in existence in every country and they will often allow a corporate to meet a large swath of startups at once and have speed pitches. Incubators typically offer you office space among a plethora of different startups so your innovation team can engage and learn from them on an ongoing basis. In some cases this can lead solely to potential commercial agreements if you’re not ready to invest in the space yet.

Walk: Another hands off approach if you’re interested in more financial vs. strategic returns is to invest off the corporate balance sheet in an existing VC fund. Many VC’s already have corporate LP’s on their roster. This model takes a lot of the management out of the corporate parent and offloads it to the GP’s at the VC firm. They have significant relationships and deal/structure expertise in the sector that would be difficult for the corporate to compete with. The VC firm could also make intros to their portfolio companies for purposes of commercial partnerships or to be a potential lead investor.

Run: Create an in-house VC unit and staff up accordingly. This arguably gives the most control but it takes a more concerted commitment to embrace the space for the long run. Most in-house corporate VC’s need to be given a strong amount of autonomy to operate and there needs to be a clear investment thesis and strategic rationale. Also, the innovation team within your corporation has to embrace the initiative and see it as complementary (not threatening) to existing R&D efforts. Lastly, there are now VC-as-a-Service firms that will manage this effort for you. They operate as if you’re their sole LP and can spend more time working with your corp development/innovation team on crafting an effective investment strategy. I like this model because you get access to more deal flow through their relationships but can also run a leaner operation and outsource a lot of the financial due diligence and legal administration.

Structure your corporate VC arm: If you do decide to set up an in-house VC group it’s important to structure it appropriately. At minimum it’s best that the CEO of the company be on the investment committee, and ideally whomever you have lead the initiative should have unfettered access to the C-suite. The group needs significant autonomy to operate alongside the parent organization. How much do you need to start a corporate venture fund and set it up for the most success? The consensus ranges from $30-$50 million USD.

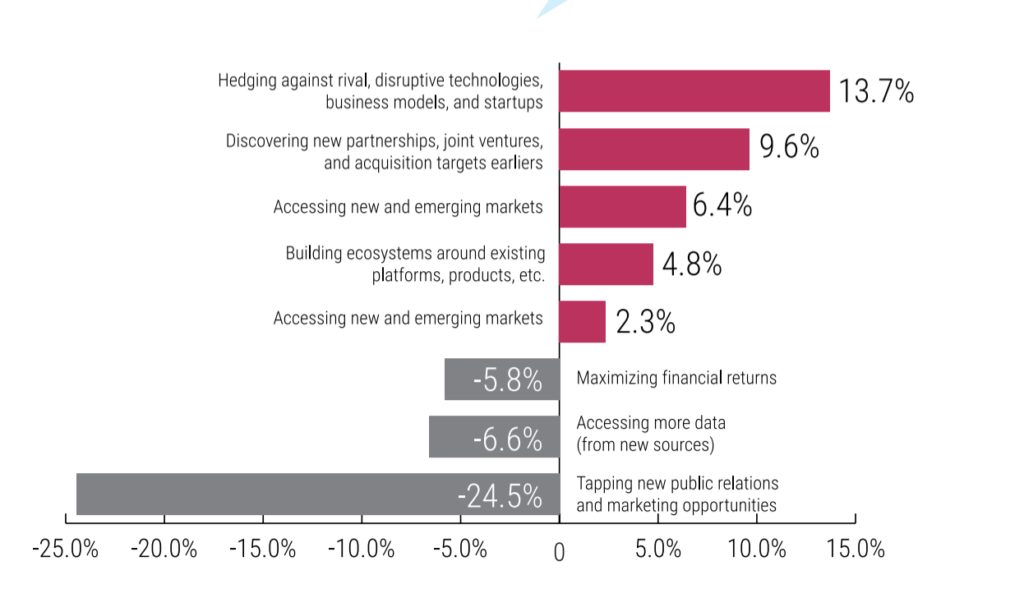

Corporate Venture Capital isn’t always purely about financial returns, in fact strategic interest often ranks higher. This survey from 500Startups shows that hedging against rival technologies and discovering new partnerships and JV’s is more important, for example.

The last point I want to make is that corporate investors have gotten a bad rap historically with entrepreneurs (and a few VC’s, namely Fred Wilson, who famously said Corporate VC’s are the Devil). I’ve seen my fair share of non-founder friendly terms being proposed – items like capped upside, ROFR’s on pricing, absence of pay to play provisions and stipulations related to working with competitors but these are subsiding as CVC’s further prioritize financial returns over purely strategic ones. There are companies that have been doing it well: GV, Comcast Ventures and Intel Capital for example. The challenge has been that historically companies get into corporate VC when the market is hot and they exit when it’s not. This leaves the entrepreneur with a risky relationship and an absence of help and mentorship when they need it most. So it’s important that if you get into this space, you make a commitment from the top of the organization that you are going to embrace the startup ecosystem with terms that carry parity with other investors and plan to stay operational for 5-10 years. The recent Covid inspired downturn is bucking that trend as can be seen from the chart below. CVC’s are remaining quite active despite the macro environment.

There’s a lot to takeaway here, but if you want to learn more about any of these areas, please reach out to me.

5 comments on “The Innovator’s Dilemma is Real and Corporations Need a Strategy”

Thanks for sharing your thoughts. Very helpful info for my new start up! I look forward to checking out that book.

[…] backed startups are pushing innovation to market faster than industry incumbents as I talk about here, VC’s still have to answer to their LP’s and their main goal is an exit (M&A or IPO) which […]

This site was… how do I say it? Relevant!! Finally I’ve found something which helped me.

Thank you!

It’s actually a great and useful piece of information. I’m happy that

you shared this helpful information with us.

Please keep us informed like this. Thank you for sharing.

My brother recommended I would possibly like this web site.

He was totally right. This submit actually made my day.

You cann’t imagine simply how a lot time I had spent for this info!

Thanks!