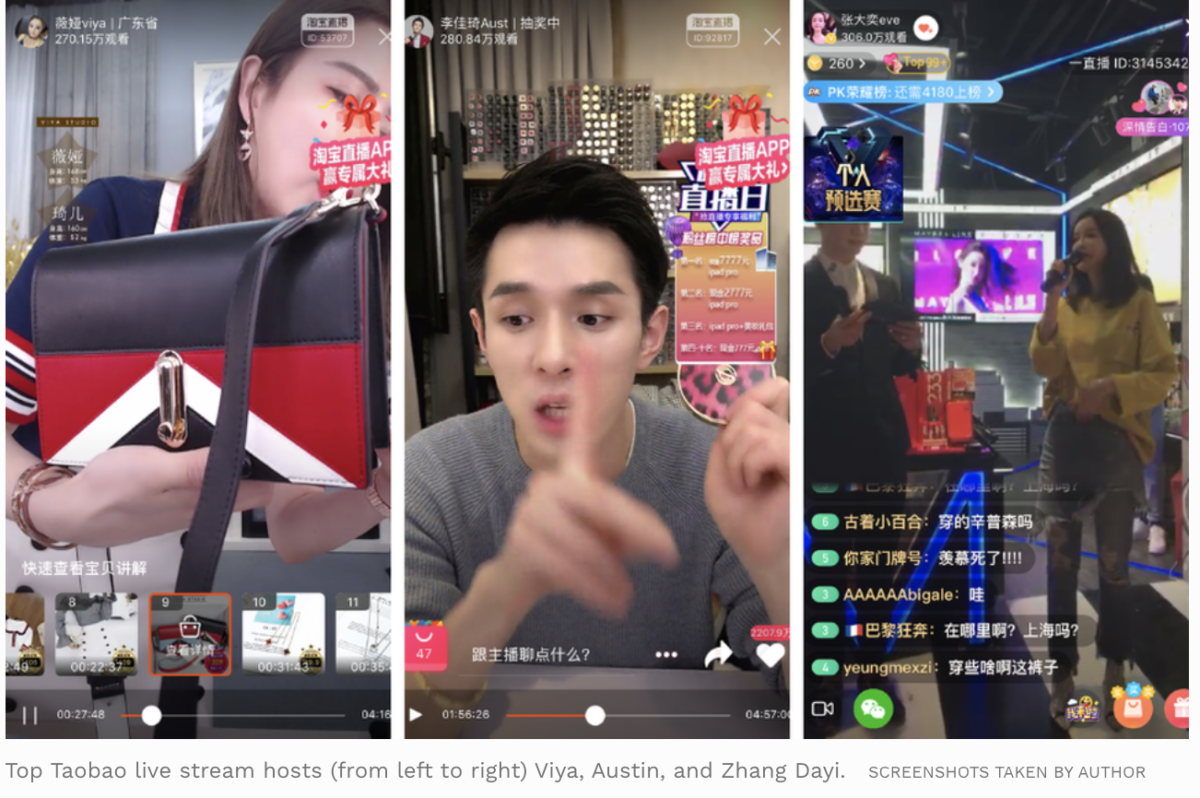

For US brands that are considering testing out Asia before jumping head first into the market, they should consider the rise of e-commerce live streaming options that are proliferating in the far east, especially in China.

Back in October of 2019, I wrote a piece on how all the value creation was essentially being captured in the private markets and retail investors were being left out. It wasn’t always this way (think Amazon or Neflix’s IPO). Over the last 3-5 years, startups have been staying private longer as late stage capital keeps funneling in. Blame traditional firms like TRowe and Fidelity, and Softbanks massive Vision fund among others, for providing the cash. Venture has always been an alternative asset class and fund managers are seeking growth in areas outside of traditional channels.

I love to travel so when an opportunity comes up I head somewhere international. This year, my trip was to Peru which I had never visited before. As the Coronavirus pandemic was just building in early March, I started to think will my fight be cancelled for March 10th. In the week prior, I had started to see people buying hand sanitizer but for the most part things were calm and it was just another day commuting on the subway in New York. The idea of social distancing didn’t exist and virtually no one wore face masks. So the night before my flight, I made a final decision that I was going to go.

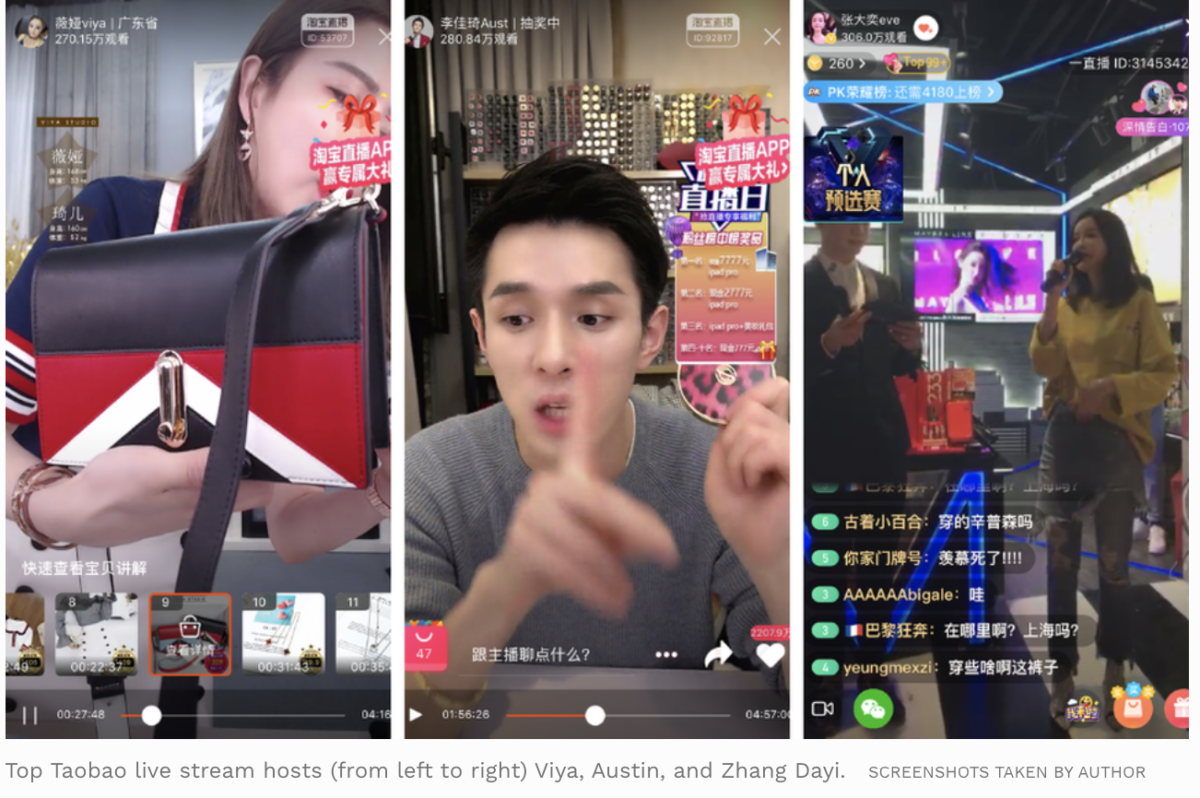

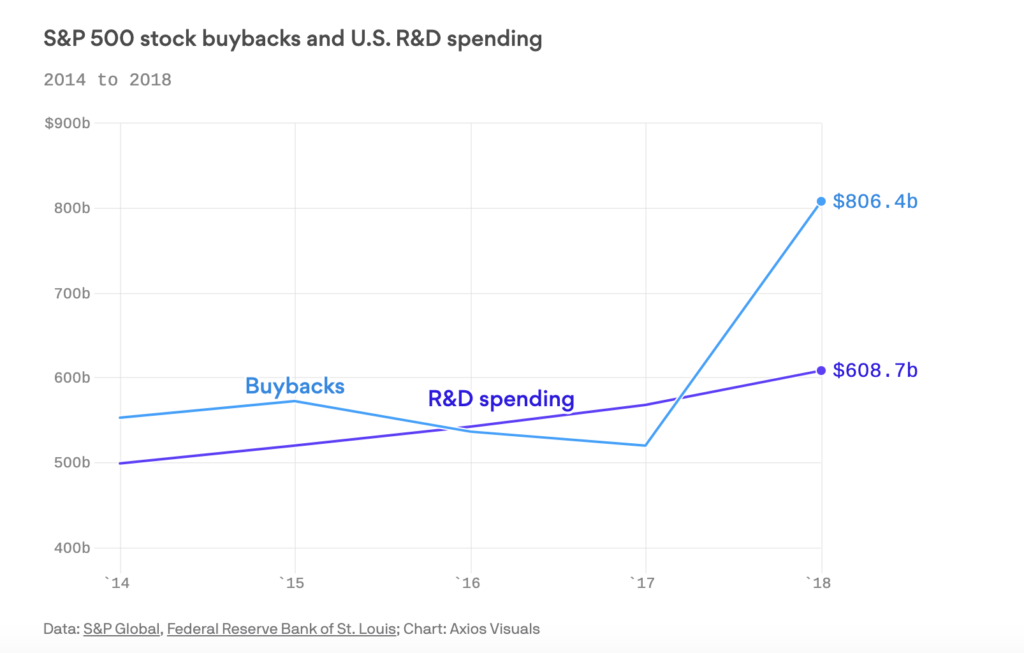

Less than half of the S&P 500 invest any money in R&D. Instead, they are pumping dollars into stock buybacks that ultimately provide no real tangible value to the productivity of the enterprise (sorry Warren). I’m convinced this is stifling innovation and giving startups more room to eat their lunch. Wall Street has no patience when it comes to waiting around to see innovation bare fruit which can sometimes take 4+ years. The unfortunate reality of this is management must then live by a quarter-to-quarter clock which hurts internal innovation. This myopic perspective is further reinforced by hedge funds and activist investors who are chasing short term gains. Allocators of capital need to recognize that management has to be given more leeway to invest for the long run. If they don’t, a heavily funded lean startup will be glad to take their customers.

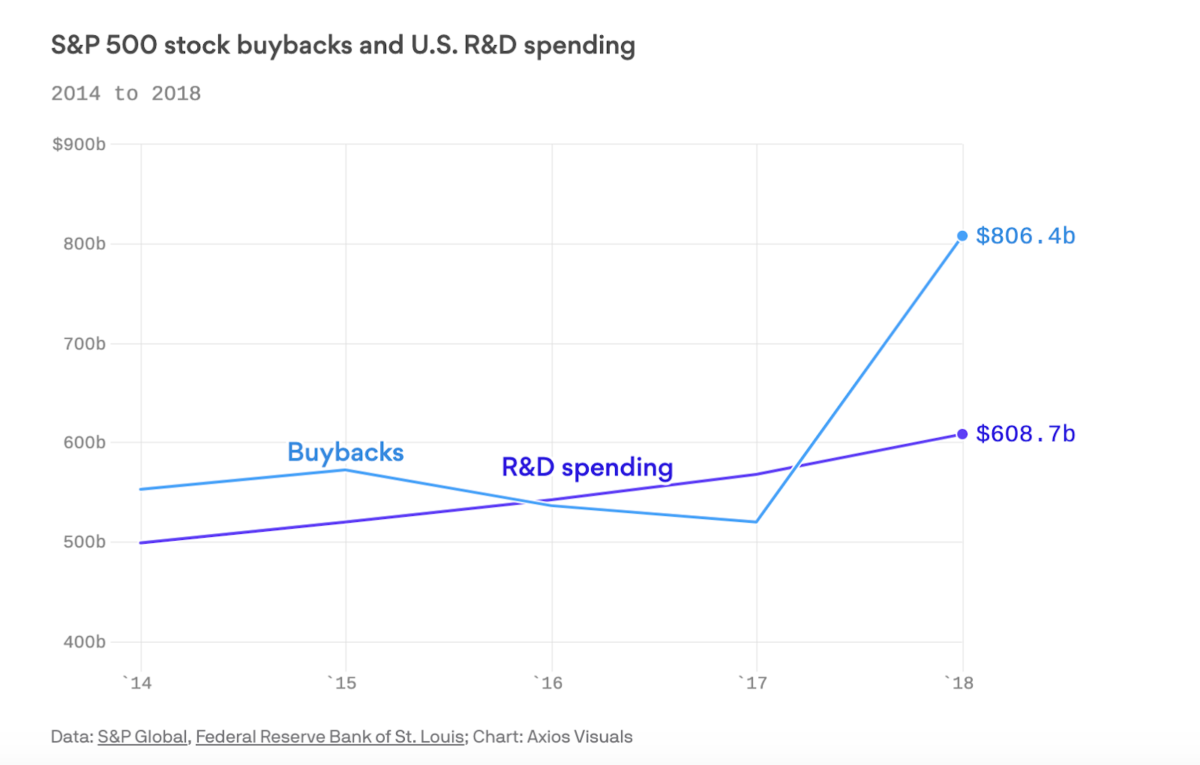

Startups usually focus on pain points that consumers have found with large bureaucratic companies. The old guard typically misses the signs when an insurgent brand comes on their turf, or they simply believe it’s not going to be a threat. Meanwhile this gives the entrepreneur time to build up a small loyal group of customers. As a result of corporate venture capital teams, and an increased interest in following startup land closely, corporations are no longer sitting back idle while startups take share.

If you haven’t read the Innovator’s Dilemma by the late Clay Christensen I highly recommend it. For those who work in innovation, this book is a wealth of knowledge on how to structure your company to embrace new technologies. Prior to joining the startup world, I spent nearly 9 years at a large S&P 500 corporation where I witnessed firsthand how slow and cumbersome these giant companies are. We held significant market share in many of the niche categories we dominated but slowly it became clear that insurgent brands (startups) wanted a piece of the pie. When large incumbents want to innovate it can sometimes take years to get a new product to market and ultimately the customer (which sometimes can be a buyer at a large retailer) may not even want it. A Harvard Business Review study estimated that at least 75% of internal new business endeavors fail – and this assumes R&D is even a priority. In 2018, less than a half of the S&P 500 companies recorded any R&D expense. The reason for this? Blame share buybacks. Over $200b more was spent on buybacks in 2018 than R&D and one would argue that this has little to no influence on the productive nature of the company. Hedge funds and activist investors chasing short term wins are further enabling this behavior.

Meanwhile tech companies who are spending in R&D are reaping the benefits. Startups are getting products to market 3x faster than incumbents (Bain & Co: 2018). So as a corporation, you must refine your innovation strategy into three parts under a buy, partner, build scenario or be left like one of these folks.

This piece from the NYTimes highlights that B2B (or B2B2C) can be sexy again. Consumerization in this space recently led by Slack, Zoom and Affirm, among others, has shown that there is an increased interest in the sector both from investors and enterprises/end users.

A lot of what we’re seeing in the news recently with public markets not being receptive to the latest wave of tech IPO’s is ultimately the result of quasi-IPO’s that have been led in the private markets as a result of significant later stage funding from conglomerates like Softbank and crossover firms like TRowe and Fidelity. This is an upward bias at its finest and cracks are starting to show in the thinking.

As Amazon took off here in the US, another similar startup business took its sights on the Far East. Alibaba may look similar to AMZN but under the hood they are very different. While AMZN handily beats BABA on top-line, BABA wins by a large measure on opex margins. This is inherent in their business model which is more similar to Ebay than to AMZN. Whereas AMZN primarily owns warehouses and inventory, BABA is lighter and collects a merchant fee as a middleman between buyers and sellers.

By guest author: Brandon Tendler

As Jorge Hernandes arrives at his destination in a darkly lit industrial complex off the beaten path in North Miami, he sees a small sign that says “pick up here”, Jorge enters the facility where about 7 other delivery drivers await, all of their names listed on the wall with real time updates tracking where their orders are in the kitchen. He notices in the back several separate units, each has its own prep area, kitchen and packing station. The to go bags leaving the facility are all adorned with different brands and contain different cuisines from new restaurant brands never heard of before.