A bit of a longer post today given all the platform deals that have been taking place (Waymo partnering with Uber, ChatGPT rolling out services from booking hotels to buying physical items, etc), that I wanted to share my experience having done these types of deals along with key learnings.

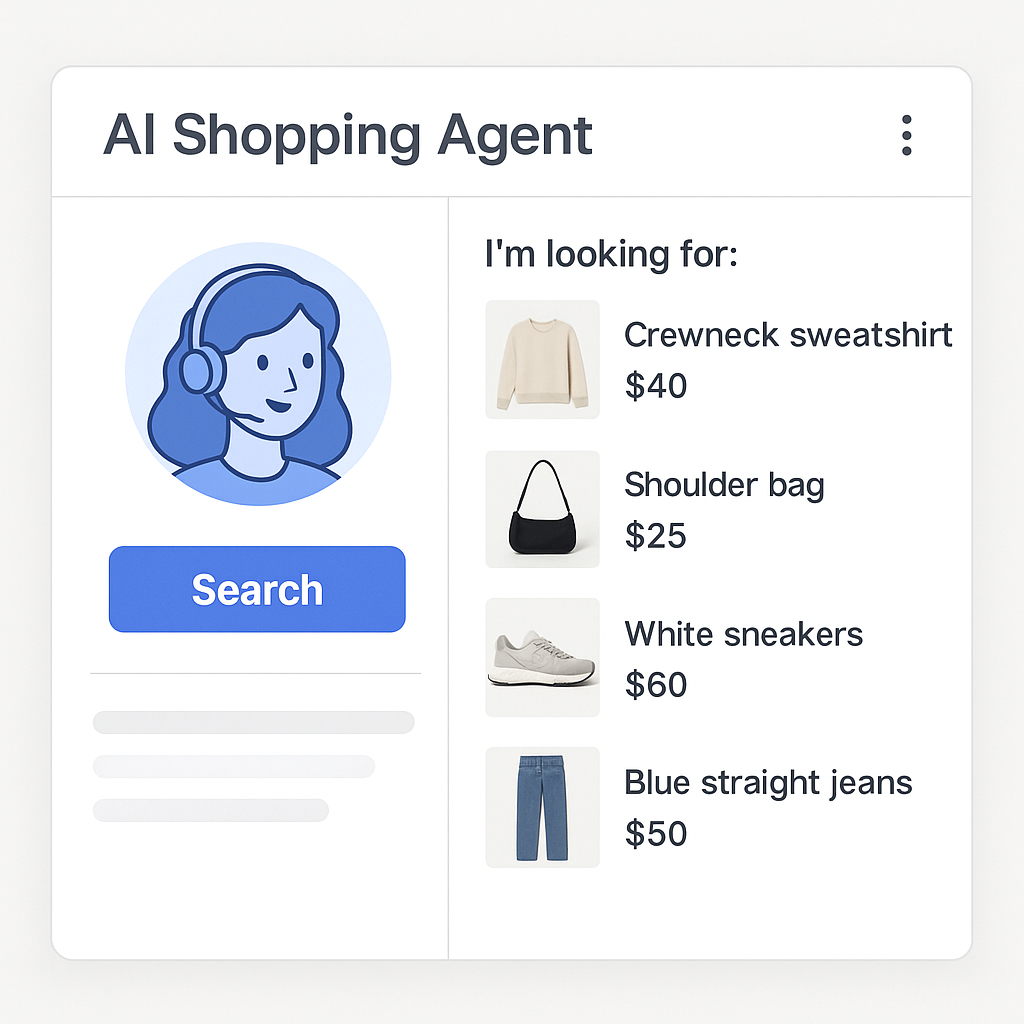

I’ve been reading daily, both articles and through posts on LinkedIn, about OpenAI enabling new services via ChatGPT, everything from being able to get an Uber, to book a reservation at a restaurant to ordering groceries via Instacart. None of this is surprising since when OpenAI launched ChatGPT plugins (and later custom GPT apps), they weren’t shy about the ambition. Sam Altman effectively hinted at an “App Store for AI” being a future where you could order a rideshare, book a table, or grocery shop all through ChatGPT’s interface, without ever touching a separate app. The idea, in theory, would be an AI App Store that would unify countless services behind one conversational interface (ChatGPT), sparing us the jumble of apps on our phones. In practice, however, the execution to-date feels like its fallen short ultimately because OpenAI’s strategy emphasized breadth over depth, integrating dozens of partners quickly, at the expense of building truly seamless experiences for the end user. The result is mostly a collection of clunky, half-baked plugin interactions that feel more akin to affiliate marketing than a truly end-to-end integration.

Every new platform faces a classic dilemma whether to go broad fast or go deep on a few core use cases. Google went deep for example with products like Google Maps enabling only affiliate type links for 3rd party partners. OpenAI clearly chose to go broad, opening a wide range of ChatGPT plugins in months. Unfortunately, many of these integrations lack the tight product coupling needed to make them useful. The user experience feels disjointed. This isn’t a new problem. I’ve seen the pitfalls of “breadth over depth” play out before, across various partnership bets in tech. In fact, five firsthand partnership anecdotes from my career illustrate why shallow integrations underwhelm, and why deep, end-to-end integrations are what truly drives the best experience for the customer. Each story, from ride-hailing to meal kits, carries a lesson that OpenAI (or other platforms) would do well to heed.