When I consult companies I often get asked about either building a DTC (direct-to-consumer) strategy or growing wholesale/retailer partnerships. The argument for DTC is rooted in the continuing belief that it’s more profitable than selling your physical product through retailers. But what if it’s really not? There’s definitely arguments in support of a DTC strategy (better control of the brand experience, ability to collect 1st party data for consumer insights, offer a more personalized customer experience, etc) but it’s important to be realistic with your investors/stakeholders that there’s very likely a fallacy that it will be better for the bottom line.

The Gross Margin Story: When you’re selling direct, you book higher revenue per item than you would selling into retail and therefore the gross margin figures for a DTC play vs wholesale are also higher. BMO Capital Markets, which has analyzed numerous publicly traded companies that have a DTC and wholesale selling strategy, found that DTC will drive a nearly 24% higher gross margin rate. This is one of the data points that lead many to believe that selling direct should be a priority.

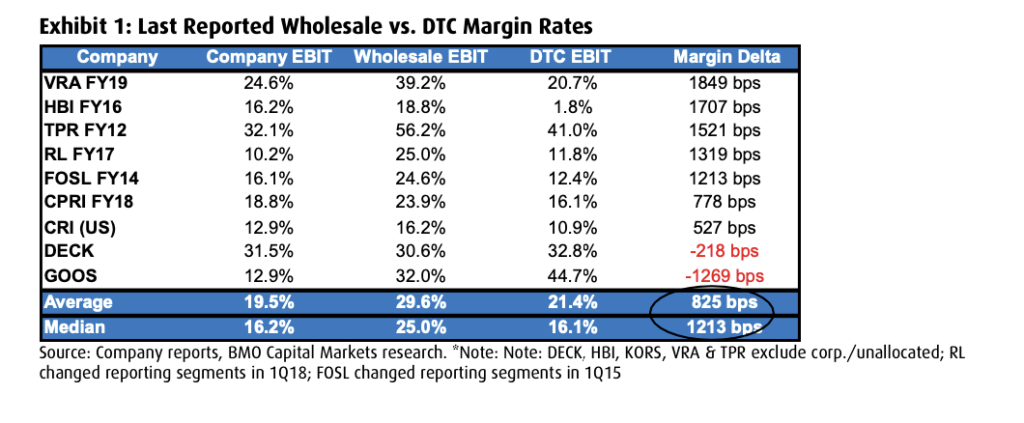

But what’s interesting is that when you look at operating margins of many publicly traded consumer product companies, you find that wholesale is higher. With the exception of a select few, namely Canada Goose, there’s an average 8% margin delta between the two sales channels.

There are a few arguments one might make of why this is the case but each has been studied and shown to not have a direct correlation. Factors such as licensing revenue (which is quite profitable) and geographic sales mix both still don’t materially change the narrative. So what’s happening here? What expenses in the DTC model offset the more favorable gross margin profile.

Marketing – take a company like Casper which reported in Q3 of last year $156m in revenue $38m in marketing spend. I would surmise that the vast majority of those marketing $ were spent on paid media tactics driving DTC, since wholesale channels don’t usually require that level of expenditure as stores attract their own customer base. Furthermore, captured in those marketing figures are items like consumer financing which can typically cost upwards of 5-7% of applicable sales. This is an expense, which DTC brands don’t incur if they sell products via wholesale.

Secondly, there’s G&A. Infrastructure is required to build a DTC business – a front end tech platform, CRM, and data analytics tools. While one would argue these products are quite affordable given their cloud based nature, many of the companies I’ve worked with have bespoke tech on top of cloud based solutions. This all adds to the cost to keep the online storefront up and running. People are the last large expense here. Because DTC brands require a lot of marketing spend to drive awareness, they equally require human capital to run these programs, further eating into operating margins.

Now, think about the costs involved to spool up a wholesale business. While you’ll likely be starting with lower gross profit dollars, your fixed expenses will be significantly less than selling DTC. You won’t have a massive tech stack to support or advertising/marketing costs for that matter, coupled with a smaller amount of overhead. One fulltime wholesale account manager could oversee a multi-million dollar opportunity from a single retailer, for example.

When I speak to the large Amazon aggregators (which I’ve written about prior) like Thrasio, Perch and the like, they all believe a key area of growth is selling directly to the customer. However, as they are discovering, it’s been difficult to see the impact to the bottom line that was anticipated. This is one of the key reasons many DTC brands today are embracing wholesale, and to even more of an extent, marketplaces (i.e. Walmart.com, etc), which often only have a 15% take rate. After all, if you’re spending 25% of sales on marketing for your DTC brand why wouldn’t you do business with a marketplace like Walmart where you don’t have any marketing expense and still come out 10% ahead. When I get asked if popular DTC brands like Casper ($CSPR), Peloton ($PTON), Warby Parker ($WRBY) or AllBirds ($BIRD) could become profitable, It’s clear there’s definitely a path, but management teams continue to artificially buy growth in DTC while still believing its overall a more profitable endeavor, and as we’ve discussed, that may not be the case.